Blog Posts Tagged with Site Features

You Can Now Sync Schwab, E-Trade and Vanguard Portfolios!

Video: Technical Analysis with SwingTradeBot

Over the weekend my good friend Duru posted a video (on his "Dr. Duru Diagnoses Markets" YouTube channel) of his stock screening process using SwingTradeBot. I think it will be helpful to those new to the site and/or new to technical analysis.

State of the SwingTradeBot Mobile Apps

>Earlier today someone asked me: "you ever thinking of updating your android app?". Here's the TL;DR answer:

No, the mobile apps have been abandoned. They'll work as is for as long as Google and Apple will keep them in their app stores and the device operating systems are compatible.

There's really no reason to use the apps, aside from push alerts. And I'm planning on adding push alerts to the website now that Apple has finally allowed them on Progressive Web Apps.

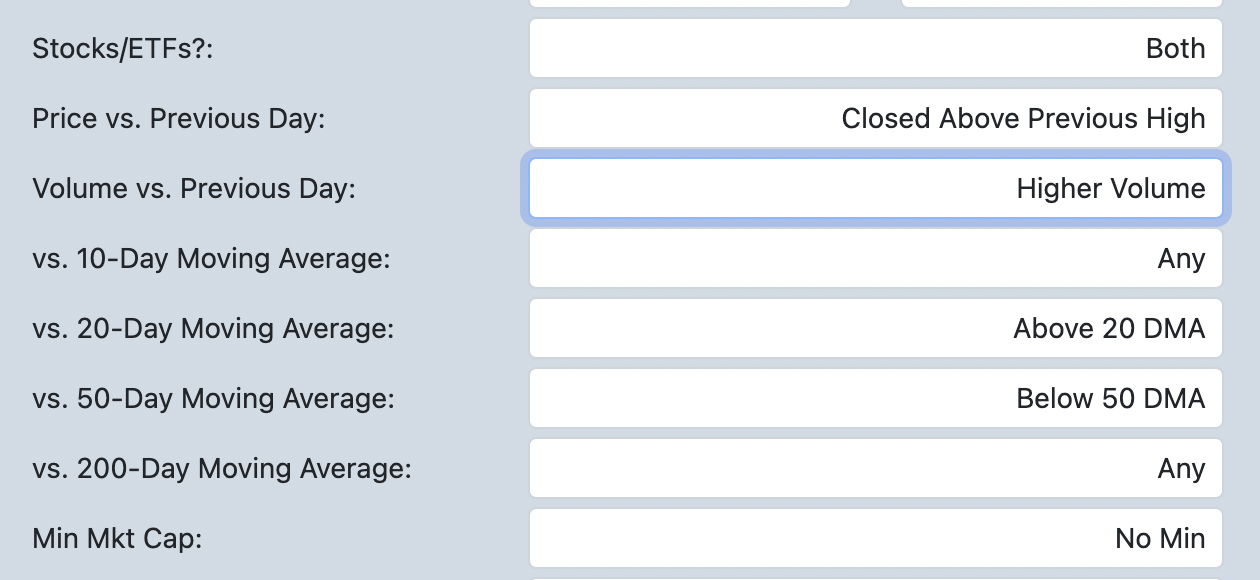

Several New Scan Filters

- Closing Price vs. Previous Day's High or Low

- Volume vs. Previous Day (greater than or less than)

- Closing Price vs. 10-Day Moving Average (above or below)

- Closing Price vs. 20-Day Moving Average (above or below)

- Closing Price vs. 50-Day Moving Average (above or below)

- Closing Price vs. 200-Day Moving Average (above or below)

Sync Your Fidelity Portfolio with SwingTradeBot

Good news for those of you who have Fidelity brokerage accounts -- you can now sync your Fidelity portfolios to SwingTradeBot . Here's the current list of supported brokerages:

Read More ➞Brokerage Portfolio Syncing is Back!

Those of you who've been using SwingTradeBot for a few years may remember when I last announced portfolio syncing in 2018. Unfortunately the service I was using went out of business in 2020 and so the portfolio syncing stopped working. I was very disappointed when that service went away because the automatic syncing was a great way to stay up-to-date with SwingTradeBot's analysis on your current holdings.

Well I'm glad to announce that portfolio syncing is now back! This time it's powered by SnapTrade / Passiv. Unlike the previous service provider, this one actually has a business model -- they're charging actual money for their services. :-) (And they're backed by Y Combinator) That means two things:

Read More ➞Scanning for Back-to-Back Signals

A few weeks ago I added a new type of scan which I've called "Back-to-Back". It enables you to find stocks which have made certain signals on up to 3 consecutive days. For example, you can scan for stocks which fell below their 50-day moving average on one day and climbed back above the 50 DMA on the next day.

Read More ➞New Features & Site Updates

Here’s a quick rundown of some new things on SwingTadeBot

- Unlimited number of Watchlists & Portfolios for Platinum Plan subscribers

- Ability to copy intraday alerts configuration from one watchlist or portfolio to another

- In case the nightly email digest doesn’t reach your inbox for some reason, you can now view the nightly email digest on the site

- You’ll now see intraday percent change (except for OTCBB) in more places, like the tag, ETF holdings & intraday alerts pages

- Related ETFs for tags

- Recent News on Tag, Industry & ETF holdings pages

- Enhanced ETF Holdings pages

- ETF Comparisons

- A ton of behind the scenes things to improve performance and keep the data flowing smoothly.

Year-End: Perfect Time to Evaluate your Process

There's a video by David Keller, which I linked in the featured links section, titled: "Re-Evaluating Your Process". It really resonated with me that 3 of his questions were about routines. I certainly recognize the importance of having good routines and sticking to them, which is why I created the routines section of SwingTradeBot. (Here's my original blog post about the routines functionality.)

Read More ➞Even More (Almost) Real-Time Stock Alerts

With the extra volatility these days I'm finding myself checking in on my intraday alerts more frequently. They were a great help in finding some of my favorite names (FSLY & TDOC) bouncing off key levels for day trades last Friday. So I've been thinking of more alerts I could have SwingTradeBot generate. Here's the latest batch:

Read More ➞New Intraday Alerts Functionality

Here's a rundown of a few things I've added around Intraday Alerts:

Read More ➞New ETF Holdings Functionality

I spend an inordinate amount of time updating & cleaning up data that comes into SwingTradeBot. A good portion of that is removing acquired & delisted stocks and filling in missing data for newly listed stocks & ETFs. So I see a ton of ETFs being added to the market every month.

During the pandemic some of the names and/or tickers of these new ETFs piqued my interest -- such as GERM & Work From Home ETF (WFH). So I started wishing I could see their holdings right on SwingTradeBot. Luckily one of my data providers has ETFs components as part of their service. So I wrote some code to start ingesting that data and displaying it on the site.

Read More ➞Site (and App) Updates from the Last Few Months

Here are some new additions to SwingTradeBot from the last few months.

Earnings Calendar

There's now an earnings calendar section of the site. (It's also listed in the Research Menu.) This will allow you to go forward in time, unlike the earnings scan.

Read More ➞Filter Scans by Stocks with Options & Weekly Options

For a few months now, you've been able to filter scan results by stocks with options (which are optionable). Earlier this week, by request, I also added the ability to filter by stocks which have weekly options. Here is where you can find those filters:

Read More ➞New Feature: Intraday Alerts (and a Mobile App Coming Soon!)

Update: The SwingTradeBot mobile app has been released for both Android and iOS.

You may have seen some new links around the site today. I've added some intraday alerts ito the mix. These alerts are *near real time* -- they may be delayed from 1 - 20 minutes. But I think they're still very useful, as long as you're not trying to be a scalper with them.

You'll be able to select from a list of things to which you want to be alerted. This functionality is in beta now and it may be a little buggy. I'll be tweaking things over the next few days. So if you noticed anything weird please let me know.

Oh, I should add that these are only available on the US (Nasdaq, NYSE and Amex) version of the site. That's because that's the only version of the site for which I have intraday quotes. (Edit on May 8th: They are now also available for the Australia/ASX, Canada and UK/LSE markets.) If I can find a reasonbly priced quote source for Canada, Austrailia and the UK, then I'll turn on these alerts for those markets as well.

Here's the initial list of alerts:

Read More ➞New Feature: Sync Your Brokerage Account to a SwingTradeBot Portfolio

***We've switched to a new syncing service. See the details here***

Thanks to the good folks at Trade.it and their API you can now sync your actual brokerage account to a SwingTradeBot portfolio. No longer will you have to manually add & remove positions in order to match what’s in your portfolio. SwingTradeBot will sync your portfolio a couple of times each day to keep things updated for you.

Here’s how to connect to your brokerage:

Read More ➞New Feature: Import Stocks into Your Portfolio from a CSV File

For a long time I've wanted to make it easier to keep my SwingTradeBot portfolios in sync with my actual brokerage portfolios. Today I've come one step closer to that goal. I just released a new feature which allows you to import stocks into a portfolio from a CSV file. There's now an 'Import Stocks' button next to the portfolio's name:

Clicking that button will open a pop-up which will allow you to select the CSV file to upload.

Read More ➞You Can Now View Scan Results as a List of Charts

I just released a new feature which will be a huge time saver when looking through scan results. There's a new option which allow you to see up to 20 charts at a time. It looks like this:

Read More ➞New Feature: Scan Within a Date Range

Scanning for a given pattern / signal over a range of dates is a feature I've wanted for a long time. A nice side-effect of the recent change I made to the way things are stored in the site's database is that it's now much easier for me to build that capability. Over the last couple of weeks I received a few requests for adding a date range to the scans. So starting today paid subscribers will be able to run scans across a date range. You'll see that there's now an end date as part of the search / filter criteria.

Read More ➞Check Out the New 'Articles & Podcasts' Section

I've added a new "Articles & Podcasts" section to the site. Throughout the day it pulls in new content from several sources I've selected (some of my favorite sites and podcasts). It'll will contain a mix of stock-specific comentary as well as more general trading information / education. I'll also be manually posting links from time to time. (You can find the link to it in the site's navigation menu under Research > Resources > Articles & Podcasts)

Read More ➞Recent Comments

- TraderMike on BOOT

- Dr_Duru on BOOT

- TraderMike on Stochastic Reached Oversold

- SuccessfulGrasshopper897 on Stochastic Reached Oversold

- Cos3 on Adding float as advanced filter criteria?

From the Blog

Blog Tags

Featured Articles